The smart Trick of Personal Debt Collection That Nobody is Talking About

Wiki Article

7 Simple Techniques For Debt Collection Agency

Table of ContentsHow Business Debt Collection can Save You Time, Stress, and Money.The Definitive Guide to Dental Debt CollectionThe 3-Minute Rule for Debt Collection AgencyThe Ultimate Guide To Business Debt Collection

A debt collection agency is an individual or company that is in business of recouping money owed on overdue accounts. Several financial obligation collection agencies are employed by business to which money is owed by people, operating for a flat charge or for a percent of the amount they are able to gather.

A financial obligation collection agency tries to recuperate past-due financial obligations owed to lenders. Some financial obligation collectors purchase overdue financial obligations from financial institutions at a discount as well as then look for to accumulate on their own.

Financial debt collectors who go against the guidelines can be filed a claim against. When a consumer defaults on a financial debt (meaning that they have actually stopped working to make one or more required repayments), the lending institution or lender may transform their account over to a debt collection agency or debt collectors. Then the financial debt is said to have actually gone to collections (International Debt Collection).

Some business have their very own financial debt collection divisions. The majority of find it easier to hire a financial debt enthusiast to go after overdue financial obligations than to go after the clients themselves.

6 Simple Techniques For International Debt Collection

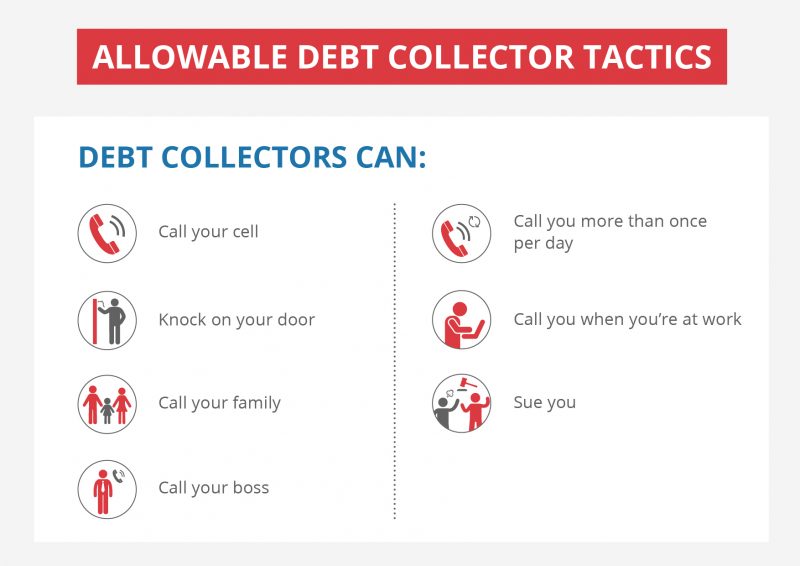

Financial obligation enthusiasts may call the person's personal as well as job phones, as well as even reveal up on their front door. They might additionally contact their family members, good friends, and neighbors in order to confirm the contact info that they have on data for the person.m. or after 9 p. m. Neither can they incorrectly claim that a debtor will be arrested if they fail to pay. In addition, a collector can't physically harm or threaten a debtor as well as isn't permitted to seize possessions without the authorization of a court. The legislation additionally gives debtors certain rights.

Individuals who think a financial obligation enthusiast has damaged the legislation can report them to the FTC, the CFPB, and their state chief law officer's office. They likewise deserve to file a claim against the financial obligation collector in state or government court. Yes, a financial debt enthusiast may report a debt to the credit history bureaus, yet only after it has actually gotten in touch with the debtor about it.

Both can stay on credit scores records for approximately 7 years and also have an unfavorable impact on the person's credit history, a big portion of which is based upon their repayment background. No, the Fair Financial Debt Collection Practices Act uses only to consumer debts, such as home loans, bank card, auto loan, trainee car loans, as well as medical expenses.

How Debt Collection Agency can Save You Time, Stress, and Money.

When that occurs, the IRS will certainly send out the taxpayer a main notification called a CP40. Because frauds are common, taxpayers need to be skeptical of any individual claiming to be servicing behalf of the internal revenue service as well as get in touch Dental Debt Collection with the internal revenue service to ensure. That depends upon the state. Some states have licensing demands for debt collectors, while others do not.Financial debt collectors give a helpful solution to lending institutions and various other creditors that intend to recuperate all or component of cash that is owed to them. At the exact same time, the law gives particular consumer securities to maintain debt enthusiasts from becoming as well hostile or abusive.

The CFPB's debt collection guideline requires financial obligation collection agencies. International Debt Collection to offer you with specific information regarding your financial obligation, recognized as validation details. Typically, this info is supplied in a created notification sent out as the preliminary communication to you or within five days of their first interaction with you, and also it may be sent by mail or electronically.

This notification normally should consist of: A declaration that the interaction is from a financial obligation collection agency, Your name as well as mailing info, in addition to the name as well as mailing details of the debt collection agency, The name of the creditor you owe the financial debt to, It is possible that greater than one creditor will be noted, The account number related to have a peek here the financial obligation (if any type of)A breakdown of the current quantity of the debt that reflects rate of interest, fees, settlements, and credit histories considering that a particular day, The present amount of the financial debt when the notice is provided, Info you can use to respond to the debt enthusiast, such as if you think the financial debt is not yours or if the quantity is incorrect, An end date for a 30-day duration when you can dispute the financial obligation, You might see various other details on your notification, but the information detailed over usually should be included.

Get This Report on Debt Collection Agency

Find out extra concerning your financial obligation collection securities..

When a debt goes unsettled for a number of months, the initial lender will frequently market it to an outside firm. The buyer is recognized as a third-party financial debt collector.

The FDCPA lawfully establishes what financial obligation enthusiasts can and can not do. They must tell you recommended you read the quantity of the debt owed, share info concerning your rights and describe just how to contest the financial debt. They can likewise sue you for settlement on a debt as long as the statute of limitations on it hasn't ended.

Report this wiki page